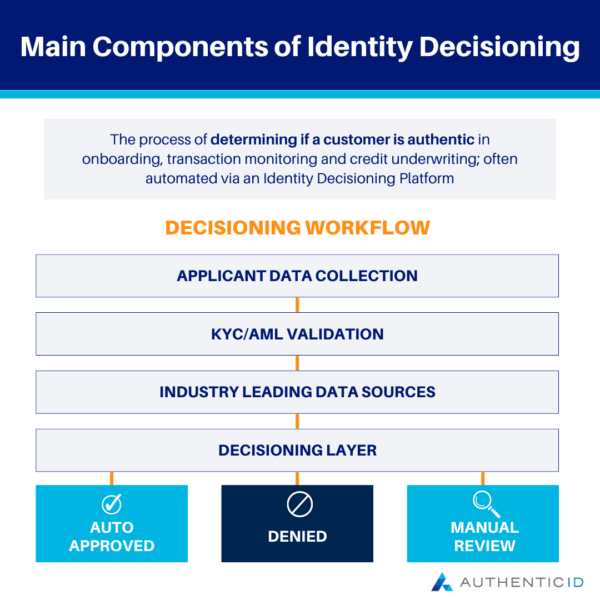

Identity decisioning is the process of determining if a customer is authentic in onboarding, transaction monitoring and credit underwriting. Companies in the financial and adjacent industries will need adequate decisioning to meet KYC/AML compliance requirements, mitigate fraud, and evaluate risk when onboarding new customers. Identity decisioning is often automated via an Identity Decisioning Platform, which is a comprehensive system for identity and risk management decisions.

Identity decisioning enables financial institutions to manage their onboarding, transactions, and credit determinations with the trust and security they require.

Identity decisioning is essential for verifying identities, keeping an eye on transactions, and deciding on credit provides you a complete picture of every customer from the moment they sign up until the end of their relationship with your business.

Identity decisioning is used to meet KYC/AML compliance standards, reduce fraud in the financial services industry, and assess risk when accepting new customers or offering new credit products. To address these issues, some businesses decide to develop their own in-house risk management solutions. Even though it may be a good choice for some, in-house solutions rarely offer the same capability and flexibility as a comprehensive IDP.

What types of businesses need to use Identity Decisioning?

Businesses and/or organization like banks, credit unions, or others in the fintech industry where is it essential to perform KYC/AML checks when onboarding new customers or employees need to utilize Identity Decisioning and/or an Identity Decisioning platform (IDP). These organizations are required to monitor their customer’s ongoing financial activity to prevent fraud or report financial fraud and crimes, and organizations that have a product where they have to underwrite customers’ line of credit should all consider using an identity decisioning platform to help them make better and quicker identity and risk decisions.

What are the main components of Identity Decisioning?

Through the whole client lifecycle, from the initial touchpoint (creating a bank account) through continuous touchpoints like credit applications and transactions, IDPs can ensure secure and smooth consumer experiences. They do so through a few key methods.

Onboarding: Verify the PII information provided by new applications, cross-reference it with KYC and AML standards, and precisely automate the decision-making process for new clients.

Credit Evaluation: Utilize the data you obtained during onboarding to make quicker and more knowledgeable credit choices.

Tracking Transactions: Throughout the whole customer lifetime, keep track of your clients’ continuous financial activity and flag any suspicious or fraudulent behavior to assist you to prevent fraud and stay compliant.

Why should a business use Identity Decisioning?

- Ability to integrate your existing tech stack seamlessly.

- Give customers a secure and easy experience; raise conversion rates by automating additional choices.

- Access to a wide range of data sources; pick the best ones for you and your company and incorporate them all into your IDP.

- Make your fraud prevention technology future-proof and stay current with the fraud landscape’s constant change.

- By planning your workflows and incorporating new data sources without writing any code, you may free up engineering resources.

- Investigate fraud attacks and improve procedures by utilizing a team of compliance and fraud specialists from your IDP vendor.

- With KYC, ongoing account monitoring, and credit application information in one platform, get a comprehensive, developing view of the identification and risk information about your clients.