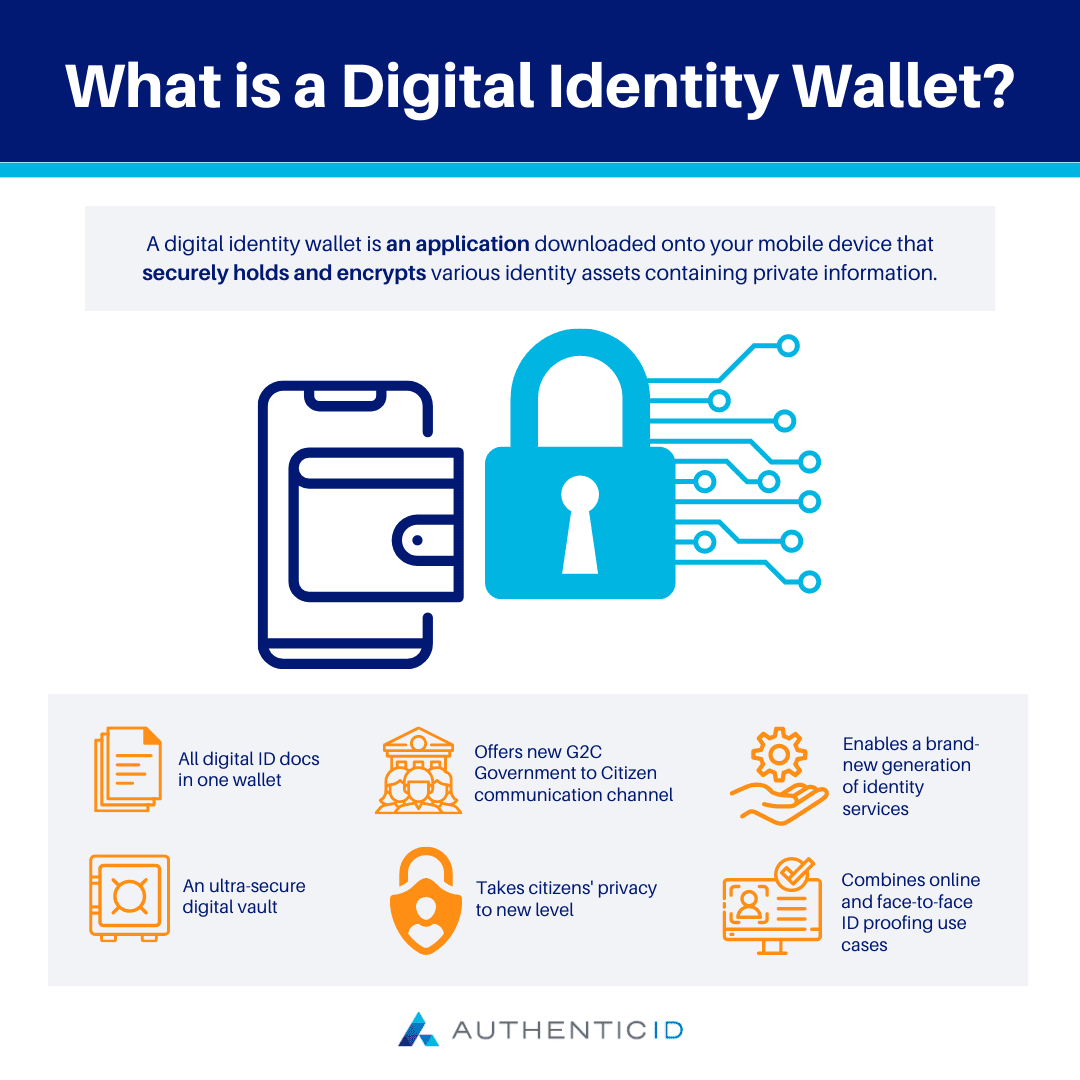

A digital identity wallet is an application downloaded onto your mobile device that securely holds and encrypts various identity assets containing private information. The application allows users to access pertinent personal documents without carrying an original, physical copy. Identity validation assets include items like your driver’s license, passport, birth certificate, insurance card, social security card and more. When asked to verify your identity with a digital identity wallet, you would have your wallet scanned rather than showing your ID, similar to scanning a barcode or QR code.

As the world becomes increasingly more digitized, the use of Digital Identity Wallets is set to skyrocket. According to Juniper Research, the number of digital identity applications in use will surpass 6.2 billion by 2025, up from just 1 billion in 2020.

Thus, understanding what Digital Identity Wallets are, what they can be used for, and what their possible limitations are will be important to know as they become more commonly utilized in our world.

What Is a Digital Identity Wallet?

A Digital Identity Wallet is an application where you can store and manage your personal identity data online.

Digital ID Wallets often contain credentials and other identifying information like:

- Name

- Date of birth

- Driver’s license

- Government ID

- Professional licenses

- Certifications

- And more

Having a Digital Identity Wallet makes it easy to share and store your credentials and identification information all in one location, without having to manage and carry around the physical copies.

How Does a Digital Identity Wallet Work?

People using Digital ID Wallets can upload certain documents, identifying credentials, and other personal information into the application to be stored, managed, and shared online.

Some of the main pieces of technology that enable Digital ID Wallets include things like:

- Verifiable credentials: digital documents that can be used to verify your identity and other key information about you

- Decentralized identifiers (DIDs): a digital identifier that is unique to you; often a combination of letters and numbers that distinguishes you from other online users

- Blockchain

These innovations work together to keep data safe and secure in the application, while still being user-friendly and convenient.

Specifically, people who use Digital Identity Wallets like the advanced data sharing controls they can utilize, ensuring only authorized users and parties can access their data, which can be revoked at any time.

Digital Identity Wallets can facilitate more secure and convenient online transactions, which is partially why they’ve become so popular in recent years.

Benefits of Digital Identity Wallets

With such a rapid rise in popularity, the benefits of using Digital Identity Wallets are clearly abundant to users around the globe. Here are some of the most prominent advantages of these applications.

1. More Convenience

Digital ID Wallets offer the convenience of easily sharing their credentials and other identifying information with relevant parties as needed. Plus, all their relevant documents are stored in one handy location online, without having to manage different physical documents or paperwork.

This means if they need to prove their age to access a website, or gain entrance to a certain venue, they can securely present the proper credentials stored in their Digital Identity Wallet–they don’t need to have the actual document on hand, scan it into the system, and wait for it to be verified by the third party–which could take up to a few months.

In this way, Digital ID Wallets make identify verification processes much more streamlined, quicker, and more convenient.

2. Better Privacy

One of the advantages of Digital ID Wallets is that users can have greater control over who has access to their personal information, and when.

Traditionally, providing copies of identity verification documents and other personal information to third parties would allow them to store these documents and have them on hand for as long as they deemed necessary.

But, with Digital ID Wallets, users can grant access to specific documents, and remove access once the process is over with. As such, this reduces the risk of their personal information being mishandled or misused. Thus, Digital Identity Wallet users can maintain their privacy while still taking advantage of the convenience these apps offer.

3. Enhanced Security

Digital ID Wallets typically utilize advanced encryption and other robust security measure to ensure your personal information is protected and secure.

Through cryptographic keys and decentralized networks, these apps can offer better security than traditional centralized identity management systems. In return, users can enjoy a reduced risk of identity theft, fraud, and unauthorized access to their information.

The decentralized nature of these wallets makes it difficult for bad actors to compromise the security of the application or misuse your personal information.

4. Interoperability

Essential in the modern digital age, Digital ID Wallets offer interoperability across different applications, websites, and use cases. This means users don’t have to create separate credentials or accounts for different platforms or service providers.

Supporting the convenience factor, the interoperability feature of Digital ID Wallets enhances the user experience and makes the log-in process easier and more seamless across the web.

5. Cost Effective

Other forms of identity verification can be costly, while many Digital Identity Wallets are low-cost or even free in certain circumstances. Other traditional methods of verification were not only clunky and time-intensive, but they could also be quite expensive depending on the organization.

Common Uses of Digital Identity Wallets

The applicable use cases of digital identity wallets are only expanding as they become more widely used. However, here are some of the current ways that people can use Digital ID Wallets.

- Identity verification: this is the primary use of Digital ID Wallets, allowing users to securely share their credentials to verify their identity for various customer onboarding processes, KYC procedures with new service providers, age verification, and more

- Accessing government services: securely access government services and benefits digitally by presenting your verified credentials to file taxes, apply for social benefits, or obtain official documents

- Online log-ins: easily verify identity and share credentials across online services and platforms; this eliminates the need to manage multiple accounts, usernames and passwords, and other details to log into different sites online

- Financial services: seamlessly and quickly identify a person’s identity to facilitate efficient and secure transactions; can be used to open a bank account, secure a loan, make payments, or make online transactions/payments

- Travel: international travellers can use these wallets to simplify and expedite processes at border patrol and customs

- Healthcare: patients can use Digital ID Wallets to authenticate themselves and gain secure access and to personal health records, schedule appointments, and more